Melbourne University Law Review

|

Home

| Databases

| WorldLII

| Search

| Feedback

Melbourne University Law Review |

|

ANNABEL ANDERSON[*] AND HANNAH HARRIS[†]

The intractable and pervasive nature of modern slavery in transnational corporate supply chains has necessitated a range of legal measures to combat this serious human rights issue. Australia’s Modern Slavery Act 2018 (Cth) supplements the criminalisation of slavery and slavery-like practices under the Criminal Code Act 1995 (Cth). Unfortunately, these laws remain ineffective. The continuing challenge of modern slavery in transnational supply chains has been linked to the incompatibility of such laws with contemporary corporate structures and operations. Therefore, this article proposes the introduction of a failure to prevent modern slavery offence, modelled on the United Kingdom’s failure to prevent bribery offence. This article positions such an offence as a viable mechanism to enhance Australia’s existing modern slavery legal framework and overcome corporate impunity for modern slavery.

CONTENTS

The scale and prevalence of modern slavery cannot be understated. ‘Modern slavery’ is an umbrella term used to describe several legal concepts including slavery, slavery-like practices, forced labour, debt bondage, forced marriage and human trafficking.[1] Each of these legal concepts involves serious exploitation arising from abuses of power, violence, manipulation, coercion or deception.[2]

The International Labor Organization conservatively estimates that 49.6 million people were victims of modern slavery in 2021.[3] On any given day in Australia in 2021, an estimated 41,000 people were living in conditions of modern slavery.[4] As the data reveals the shocking scale of this human rights disaster, the narrative of modern slavery as an aberration on the ‘criminal fringes’ of industry has been subverted.[5] Modern slavery is increasingly viewed as an inherent feature of our economic system.[6] For instance, of the 49.6 million people living in conditions of modern slavery, 27.6 million were trapped in forced labour, 86% of whom were exploited in the private economy.[7] The large transnational corporations constituting this economic system are becoming structurally implicated as enablers of widespread human rights abuses.[8]

In Australia, conduct associated with modern slavery is criminalised under the Criminal Code Act 1995 (Cth) sch 1 (‘Criminal Code’).[9] Part 2.5 of the Criminal Code provides that corporations may be held responsible for such offences. Notwithstanding this, and despite the prevalence of modern slavery in transnational corporate operations,[10] there has been no action brought against a corporate defendant for modern slavery related offences in Australia.[11] This prosecutorial gap principally arises due to the conceptual and practical limitations in applying traditional, direct models of corporate criminal liability in the

context of transnational crimes.[12]

In recognition of the limitations of criminal law in addressing modern

slavery, alternative regulatory approaches have emerged. The Modern Slavery Act 2018 (Cth) (‘MSA’) has introduced a mandatory modern slavery reporting scheme.[13] However, early empirical research has highlighted widespread

noncompliance with this scheme, calling into question the effectiveness of

market-based enforcement approaches.[14]

The literature critiques traditional models of corporate criminal liability and market-based disclosure regimes for stifling meaningful anti-slavery progress in Australia.[15] An emerging proposal contemplated in the scholarship is the harmonisation of legal approaches to bribery and modern slavery to enhance and optimise modern slavery enforcement outcomes.[16]

Despite strong similarities between bribery and modern slavery, the legal approaches in combatting these crimes significantly diverge. The bribery framework is premised on hard law criminality relative to the softer disclosure-based frameworks for modern slavery.[17] It is suggested that disclosure-based legislative design is associated with weaker corporate policies on modern

slavery.[18] Conversely, the ‘harder’ criminal sanctions associated with bribery have compelled stronger, private sector compliance outcomes.[19] Harmonising legal approaches to these crimes, by incorporating criminal sanction into the modern slavery framework, will arguably strengthen private sector compliance.

These authors build on this conceptual foundation and suggest the introduction of a failure to prevent modern slavery offence. This proposal promotes enhanced crossover between the legal approaches to bribery and modern

slavery by importing a bribery criminalisation model into the modern slavery context. As will be demonstrated in this article, the failure to prevent model overcomes many of the difficulties presented by current corporate criminal

liability approaches.[20]

This article, which responds to the Australian Law Reform Commission’s call for further inquiry into a failure to prevent offence for transnational crimes involving human rights violations,[21] is structured as follows. Part II provides a systematic exposition of the laws criminalising modern slavery under the

Criminal Code and the MSA. It also critiques these laws, highlighting that

Australia’s modern slavery legal framework is neither fit for purpose nor

appropriately adapted to the contemporary corporate context. Part III

undertakes a comparative analysis of bribery and modern slavery, justifying the

harmonisation of legal approaches to these issues.

Part IV proposes the introduction of a specific criminal offence successfully deployed in the context of bribery: a corporate offence of failing to prevent modern slavery. Finally, Part V assesses whether the proposed failure to prevent modern slavery offence is a viable mechanism to enhance Australia’s modern slavery legal framework. Viability is assessed by reference to three factors: (i) the ability of this model to remedy the deficiencies in Australia’s modern slavery legal framework; (ii) the offence’s compatibility with Australia’s criminal law tradition; and (iii) the offence’s compatibility with Australia’s existing system of corporate regulation.

It is first necessary to analyse the various mechanisms that comprise Australia’s modern slavery legal framework. This analysis demonstrates the existing framework’s inability to effectively address modern slavery in the

contemporary corporate context.

Division 270 of the Criminal Code criminalises slavery, servitude, forced labour, deceptive recruiting for labour services, debt bondage, slavery-like offences and forced marriage. Division 271 criminalises human trafficking. The Criminal Code applies to corporations in the same way that it applies to individuals.[22] As with the majority of criminal offences, there are prerequisite physical and fault elements which must be established.[23] However, proving the physical and fault elements of an offence in respect of a corporate defendant (and in the context of transnational crimes) is incredibly difficult.[24]

Section 12.2 of the Criminal Code provides that if the physical element of an offence is committed by an officer, agent or employee of a corporation acting with authority, that physical element is attributable to the corporation. It is

pertinent to consider the meanings of ‘officer’, ‘agent’ and ‘employee’ for the

purposes of attributing corporate criminal liability.

Corporate criminal liability may arise from the conduct of an officer,[25] meaning a director, an individual with the capacity to significantly affect the corporation’s financial standing or an individual who makes decisions affecting the whole, or a substantial part of, the corporation’s business.[26] Therefore, criminal conduct is attributable to a company when perpetrated by high-level senior executives.[27] However, these individuals are often several degrees and jurisdictions removed from the actual point in the supply chain where modern slavery occurs.[28] These individuals are likely oblivious to human rights abuses occurring in the lower tiers of corporate operations overseas and rarely facilitate modern slavery in an operational context.[29]

Corporate criminal liability may arise from the conduct of a corporate agent.[30] A serious impediment in establishing this relationship is the use of foreign

subsidiary companies. In practice, transnational corporations extensively

utilise foreign subsidiary companies to manage overseas operations.[31] Foreign subsidiaries are often key enablers and perpetrators of human rights abuses.[32]

However, the ‘agent’ relationship in Australia has been construed narrowly.[33] Even complete dominion over a subsidiary — or the total financial dependence of a subsidiary on its parent — does not alone constitute a relationship of agency.[34] Thus, foreign subsidiaries have not often been considered agents for the purposes of attributing corporate criminal liability in Australia.

Corporate criminal liability may arise from the conduct of employees.[35] A substantial impediment in establishing the employer–employee relationship, in the context of large transnational corporations, is the phenomenon of third-party labour arrangements. Transnational corporations often outsource labour to contractors.[36] Contractor agreements typically contain clauses expressly stipulating that the contractor is not an employee.[37] Contractors will then often

delegate their work to another individual via subcontracting arrangements to which the original corporation is not a party and of which it has no oversight.[38] The outsourcing of labour, especially cross-jurisdictionally, is a critical dynamic facilitating exploitative labour practices.[39] However, this practice also insulates corporates from criminal liability because the contractor is not an employee whose conduct may be attributable to the corporation.

The fault element of an offence will be attributable to a corporation that

‘expressly, tacitly or impliedly authorise[s] ... the commission of the offence’.[40] Establishing authorisation can be achieved in several ways, but it is practically very difficult to establish for any corporate crime.

The first method to establish authorisation is by proving the board of directors or a high managerial agent intentionally, knowingly or recklessly carried out the conduct or authorised the commission of the offence.[41] ‘High managerial agent’ means an employee, agent or officer of the corporation with duties of such responsibility that their conduct may be fairly assumed to represent the corporation’s policy[42] or an individual ‘closely and relevantly connected with the company’ who makes decisions that impact a substantial part of

the business.[43]

As in the case of attribution for the physical element of the offence discussed above, due to the decentralisation of authority in contemporary transnational supply chains, high managerial agents and directors are usually several jurisdictions removed from the actual perpetration of modern slavery.[44] They seldom engage in the positive act of authorising modern slavery in an operational context.[45] This authorisation is likely to be effected by lower-level decision-makers whose decisions are unlikely to have a substantial impact on the

business and financial standing of the collective corporation.[46]

Second, the fault element may be established by arguing that a corporate culture existed within the corporation that ‘directed, encouraged, tolerated or led to non-compliance’ with the law or that the corporation ‘failed to create and maintain a corporate culture that required compliance’ with the law.[47] This is known as the corporate culture provision.[48] Where this is established, authorisation or permission exists for the purpose of attributing the fault element of an offence to a corporation.[49]

For example, the opacity of a company’s multinational supply chain could be construed as evidence of a corporate culture leading to noncompliance with anti-slavery laws. However, it is difficult to glean the breadth and scope of

application of the corporate culture provision as it has been subjected to limited judicial treatment.[50] It is unclear whether corporate culture is a social fact transcending an individual company such that it may be linked to a subsidiary operating in a different geographical or sociocultural context.[51] It is also unclear whether corporate culture must be construed narrowly so as to align with the doctrines of limited liability and separate legal personality. Without judicial guidance on these issues, imputing fault to a multinational corporation via the corporate culture provision remains uncertain.

The above analysis demonstrates that pt 2.5 of the Criminal Code imports a criminal liability model that is inflexible to the complex realities of contemporary corporations, which are proactively structured to externalise risk and insulate liability. A reconceptualisation of models of corporate criminal liability is clearly necessary.

In 2018, Australia passed the MSA.[52] The MSA introduced a mandatory modern slavery reporting scheme.[53] Reporting entities, including entities based or operating in Australia with a consolidated annual revenue exceeding $100 million, are required to produce a modern slavery statement reporting on modern slavery risks in their supply chain in accordance with the criteria set out in the MSA.[54] Reporting criteria include a description of the structure and operations of the reporting entity, the risks of modern slavery within this structure, actions taken to address such risks and remediation processes.[55]

The reporting criteria import elements of human rights due diligence (‘HRDD’) provided for in the United Nations Guiding Principles on Business and Human Rights: Implementing the United Nations ‘Protect, Respect and Remedy’ Framework (‘UNGP’).[56] However, actively undertaking HRDD and preventing and addressing modern slavery in corporate operations is not a technical requirement under the MSA. The legislation merely requires the reporting of modern slavery risks.[57] Critique of the MSA as a regulatory approach is strong and insistent, and many dimensions of this critique have now been articulated in the Report of the Statutory Review of the Modern Slavery Act 2018 (Cth): The First Three Years (‘MSA Review’) recently handed down by Professor John McMillan AO.[58] The elements of this critique are explored below.

The MSA is predicated on the assumption that consumers, once equipped with a modern slavery statement, will be sufficiently qualified to interpret and compare these documents and motivated to drive changes to corporate behaviour.[59] This market-outsourced enforcement approach positions consumers as powerful stakeholders in slavery prevention.[60] However, research suggests that the role of consumers in eradicating modern slavery is inflated.[61] Even if all consumers were capable of comparing and contrasting modern slavery statements across all corporations from which they purchased, many consumers are not in a position to access ethically-sourced goods and services. There are many socioeconomic barriers that present a real constraint on purchasing power. This reality underscores the unrealistic nature of ‘market mechanisms’ and the suggestion that consumers can act as unconstrained agents of ethical corporate practices.[62] In reality, the hypothesis that consumers can be relied upon to use their purchasing power to pressure corporations to deliver substantive

anti-slavery commitments is completely misplaced.[63]

Disclosure-based legislative schemes, such as the MSA, have compounded the use of social auditing in substitution for comprehensive HRDD.[64] Social auditing is a process designed to detect and measure exploitative labour conditions.[65] It is typically outsourced to third-party auditing firms that report on the ethics of various stakeholders within a corporate supply chain.[66] Ford and Nolan argue that social auditing is an ‘inherently superficial’ process.[67] It neglects the monitoring and review of lower tiers in the supply chain that are often the most vulnerable to exploitation.[68] Social auditing is typically undertaken every few years.[69] Thus, the results reflect only a ‘snapshot’ of time and are vulnerable to fraud.[70] For instance, payslips are often forged prior to inspections to convey the impression that employees are paid a living wage.[71] This necessarily means that the information reported under modern slavery disclosure schemes is low quality and neglects the underlying causes of modern slavery.[72]

The MSA’s compliance mechanism relies solely on a transparency framework,[74] based on the idea that reputational damage will be a sufficient deterrent for noncompliance.[75] Hypothetically, if a reporting entity fails to comply with reporting requirements, the Minister for Home Affairs may request in writing that the reporting entity provide an explanation or undertake remedial action.[76] If noncompliance persists, the Minister may publish a notice on the register, identifying the reporting entity as noncompliant.[77] To date, no such notices have been published in Australia despite evidence that 66% of companies failed to address all mandatory reporting criteria in their statements in the second reporting period (2020–21).[78]

In Australia, 77% of reporting entities failed to address the mandatory reporting criteria in their statements produced in the first reporting period (2019–20),[79] and only 33% of Australian companies demonstrated any form of effective action to address risks of modern slavery in their supply chain in the most recent reporting period (2020–21).[80] A lack of traditional penalty provisions is a key contributor to this noncompliance.[81] The above analysis has positioned Australia’s current modern slavery legal framework as obviously and emphatically deficient, establishing the need for improvement.

Acknowledging the significant deficiencies in Australia’s modern slavery framework, this article makes a case for harmonising legal approaches to bribery and modern slavery.[82] This argument in favour of harmonisation informs the subsequent original proposal in Part IV to introduce a failure to prevent modern slavery offence, modelled on the United Kingdom’s (‘UK’) failure to prevent bribery offence.[83]

The similarities between bribery and modern slavery offer strong justifications for the like treatment of these offences.[84] Bribery is a widespread phenomenon in international business[85] in the same way modern slavery is an intractable feature of the private economy.[86] Bribery and modern slavery are transnational crimes which flourish in diffuse, opaque and cross-jurisdictional supply chains.[87] Just as modern slavery manifests itself in an invisible workforce,

bribery is similarly hidden and discreet,[88] presenting significant (and similar)

detection and enforcement challenges.[89]

There is an inextricable causal connection between bribery and modern slavery, further supporting the convergence of legal approaches to these

issues.[90] Bribery undermines organisational integrity,[91] and the existence of bribery in supply chains has been found to circumvent sustainability standards by facilitating opportunities for human rights abuses.[92] Bribery is also an

enabler of human trafficking and exploitative labour practices.[93] Thus, eliminating bribery from international business is a valuable method to reduce

opportunities for, and the actual occurrence of, modern slavery.

In almost every jurisdiction, bribery is subject to a stringent criminal law regime, defined by robust enforcement and strict penalties for noncompliance.[94] There is a comprehensive international legal framework, including the Organisation for Economic Co-Operation and Development’s (‘OECD’) Convention on Combating Bribery of Foreign Public Officials in International Business Transactions (‘OECD Bribery Convention’), which requires states parties to criminalise bribery through domestic law.[95] The OECD Bribery Convention is designed to achieve ‘functional equivalence’ in domestic anti-bribery legislation and was followed by the United Nations Convention against Corruption (‘Convention against Corruption’).[96] As a state party to the Convention against Corruption, Australia has adopted a criminalisation framework to address bribery.[97] Penalties for corporate violations of anti-bribery provisions are substantial.[98] Unfortunately, despite this hard law framework, enforcement against corporations for bribery offences in Australia are rare;[99] this is similar to Australia’s disappointingly low levels of modern slavery law enforcement.[100] Comparative international perspectives are also instructive of the distinct legal treatment of bribery and modern slavery.

The Bribery Act 2010 (UK) (‘BAUK’) criminalises bribery.[101] Furthermore, it introduced a new offence: the failure of a commercial organisation to prevent the commission of bribery in connection with its business.[102] The BAUK imposes unlimited fines for noncompliance with that new offence and individuals may face imprisonment for up to 10 years.[103] Serious Fraud Office (‘SFO’) investigations regularly result in fines of millions of pounds.[104] Between 2016 and 2021, the SFO contributed approximately £1.4 billion to the Treasury through fines, disgorgement and confiscation.[105]

In contrast, the Modern Slavery Act 2015 (UK) (‘MSAUK’) implements a disclosure-based regime which aims to reduce the prevalence of modern slavery.[106] There are no penalties imposed for noncompliance with disclosure obligations. The regime has increased the identification of modern slavery victims.[107] However, it remains unknown whether the regime has necessitated a decrease in modern slavery as originally envisaged.[108]

There are notable divergences in the legal treatment of modern slavery and bribery. First, criminal law approaches to bribery are common cross-jurisdictionally.[109] Contrastingly, modern slavery is addressed through disclosure-based approaches.[110] Second, there are significant penalties associated with noncompliance with anti-bribery legislation.[111] Noncompliance with modern slavery disclosure schemes does not attract monetary penalties.[112] Rather, the supposed penalty for noncompliance is reputational damage.[113] Finally, there is an overarching international legal framework to achieve consistency in domestic anti-bribery law.[114] There is no equivalent modern slavery treaty to provide definitive guidance on domestic legislative design.[115]

Despite stringent criminalisation, the successful enforcement of anti-bribery law remains imperfect.[116] Much like the challenges with anti-modern slavery enforcement, difficulties of detection and measurement in a complex transnational environment involving powerful corporate stakeholders has prevented effective anti-bribery enforcement action.[117] As such, it is important to clarify that this article does not suggest that hard law criminalisation alone will

guarantee stronger criminal prevention and positive enforcement outcomes. There is considerably more to regulating the issue of modern slavery than

criminalisation, and disclosure-based regimes certainly comprise an important

component within the broader modern slavery framework.[118]

Rather, this article contends that legislative design plays a powerful role in shaping private governance behaviours and that it is valuable to consider different and alternative legal approaches which may fill gaps within Australia’s current modern slavery legal framework. The next section relevantly examines the impact of anti-bribery legal approaches on corporate behaviour, compared to the impact of modern slavery legal approaches.

LeBaron and Rühmkorf analysed the distinctive legal approaches under the BAUK and MSAUK to assess the impact of legislative design on corporate behaviour.[119] Twenty-five corporations were studied to compare their bribery and modern slavery policies.[120] Several key trends emerged.

First, the language used to communicate bribery and modern slavery governance standards significantly differed.[121] All study participants used strict language regarding bribery (eg ‘zero tolerance’).[122] This should be compared to the more aspirational language — ‘we will work to ... respect human rights or ‘we do not support forced labour’ — used in relation to modern slavery.[123]

This language discrepancy is apparent in BHP’s minimum requirements for suppliers policy, reviewed for the purpose of this article.[124] Prospective suppliers ‘must comply’ with applicable anti-corruption laws and must not make or allow facilitation payments when undertaking work for or on behalf of BHP.[125] Conversely, the supplier need only ‘affirm’ that it does not allow forced, bonded or involuntary labour.[126] There is no requirement for ongoing due diligence of supplier practices in relation to modern slavery. The former language imbues BHP’s anti-bribery requirements for suppliers with legal status whereas the latter language positions BHP’s modern slavery requirements as merely aspirational.

Second, all participants in LeBaron and Rühmkorf’s study published a bribery policy, with most incorporating due diligence assessments therein.[127] By comparison, modern slavery policies were inconsistent across the cohort.[128] Returning to BHP, this organisation disclosed an anti-bribery policy as a distinct section within its code of conduct.[129] Bribery is positioned as a governance

issue and key operational risk, associated with criminal penalties.[130] Modern slavery, however, is not referenced at any point in BHP’s code though there are scattered references to forced labour in the broader ‘respecting human

rights’ section.[131]

The conclusions gleaned from LeBaron and Rühmkorf’s inquiry, supported by additional analysis of BHP, are as follows. The stringency, form and degree of home-state regulation have significant consequences in directing company policies, practices and behaviour in respect of transnational issues.[132] The

coherent body of international law and ‘harder’ approaches to bribery under the BAUK have directed corporations to utilise their bargaining power

and incorporate stringent anti-bribery policies, practices and standards in

corporate operations.[133]

In contrast, the institutional design of the MSAUK has undermined the

effectiveness of this legislative instrument in steering meaningful corporate

approaches to prevent and address modern slavery.[134] This analysis offers a compelling case for the harmonisation of legal approaches to bribery and

modern slavery by, in particular, strengthening the modern slavery framework through more stringent criminalisation to reflect the well-established approach to bribery.

This article has proposed that harmonising approaches to bribery and modern slavery, by hardening the legal treatment of modern slavery through criminal sanction, is likely to incentivise more meaningful responses from the private sector in preventing and addressing modern slavery. It is now time to

demonstrate how such harmonisation may be achieved.

It is contended that the failure to prevent model available in the context of bribery can and should be extended to modern slavery. [135]

The failure to prevent model of corporate criminal liability consists of a standalone offence, under which a corporation may be convicted on the basis that it failed to prevent the commission of a specific offence by another legal or natural person operating within its business or supply chain (‘associate’).[136] The failure to prevent offence is accompanied by a full defence.[137] This offers a

corporate defendant an opportunity to demonstrate that it had in place

procedures to prevent the commission of the underlying offence.[138]

The failure to prevent model does not, in and of itself, require a corporation to implement and comply with any particular policies or procedures or take burdensome steps to prevent and address criminal misconduct.[139] However, corporations are incentivised to take proactive responsibility for the conduct of their associates and to foster a corporate culture of compliance such that the corporation is protected by the defence.[140]

Thus, the failure to prevent model reconceptualises criminal justice, requiring that corporations are held responsible where they knowingly commit crimes and where they are reckless, indifferent or ignorant as to the common risks associated with their business activities. Imposing criminal liability for failing to prevent certain crimes signals the heightened expectations on

corporate entities in the 21st century, acknowledging the significant harms emerging from corporate activities.[141]

To demonstrate the application of the failure to prevent model, this article considers the UK’s failure to prevent bribery offence.[142] A corporation is guilty of the offence of failing to prevent bribery if an associate, meaning a legal or natural person located in any jurisdiction and who performs services for or on behalf of the corporation, bribes another person.[143] Importantly, the associate does not need to have a direct or formal relationship with the corporation, and the capacity in which the associate performs services for the corporation

is irrelevant.[144]

It is a full defence for the corporation to prove that it had in place adequate procedures designed to prevent the associate from bribing another person.[145] There has only been one contested case involving a charge for failing to prevent bribery.[146] Therefore, there is limited judicial articulation on what constitutes ‘adequate procedures’.[147]

The UK Ministry of Justice has produced a guidance note, The Bribery Act 2010: Guidance about Procedures Which Relevant Organisations Can Put into Place To Prevent Persons Associated with Them from Bribing (Section 9 of the Bribery Act 2010) (‘BAUK Guidance’), about the meaning and scope of ‘adequate procedures’.[148] The term ‘procedures’ is described as encapsulating both an organisation’s bribery prevention policies and the procedures which implement such policies.[149] Thus, the existence of an anti-bribery policy alone is insufficient to constitute ‘adequate procedures’.[150] Rather, a corporation must demonstrate how these procedures are implemented to achieve a meaningful, anti-bribery compliance culture.[151]

The BAUK Guidance provides a non-exhaustive list of bribery prevention procedures which may be embraced by corporations. These include due diligence of existing or prospective associates, whistleblowing procedures, discipline processes and sanctions, anti-bribery training programs and financial controls, such as adequate bookkeeping and independent auditing.[152]

Importantly, the BAUK Guidance provides that a commercial organisation’s anti-bribery procedures should be proportionate to the internal and external bribery risks it faces and the nature, complexity and scale of the commercial

organisation’s activities.[153]

The BAUK Guidance draws inspiration from the OECD Bribery Convention and associated guidance.[154] This demonstrates an integration of international law concepts into domestic legal systems to provide guidance to corporations where there is limited judicial direction domestically.[155] Drawing on international standards and norms is a component of the recommended hardening of Australia’s modern slavery legal framework, which is discussed further below when introducing the proposed failure to prevent modern slavery offence.

This section now considers the extension of the failure to prevent model to modern slavery and assesses the preferred scope of such an offence. It then

presents a draft provision and considers its application.

As a starting position, the UK Joint Committee on Human Rights (‘JCHR’) considers it appropriate to apply the failure to prevent model of corporate criminal liability to business and human rights.[156] It has been proposed by scholars that the term ‘human rights’ should be defined to include all internationally recognised human rights.[157] Such a definition would include the right to freedom from slavery and forced labour as contained in art 8 of the International

Covenant on Civil and Political Rights.[158]

The Human Rights Council Intergovernmental Working Group on Transnational Corporations and Other Business Enterprises with Respect to Human Rights has produced a third revised draft of the Legally Binding Instrument

(‘Legally Binding Instrument’) which proposes that liability should arise where corporations fail to prevent other legal persons, with whom they share a business relationship, from causing or contributing to human rights abuses,[159] also broadly defined to encapsulate all internationally recognised human rights violations.[160] In the Australian context, the Australian Law Reform Commission has suggested that the failure to prevent model may be appropriate in respect of certain human rights abuses[161] though it has not yet proposed a specific statutory offence. The position of the JCHR and the Legally Binding Instrument demonstrates a strong commitment to human rights protection. However, a statutory offence criminalising corporate failures to prevent violations of every internationally recognised human right would be so expansive in scope it would likely be impossible to enforce.[162]

Moreover, an offence criminalising the corporate failure to prevent violations of every internationally recognised human right is neither clear nor sufficiently definite so as to accord with the principle of legal certainty.[163] This article therefore proposes a specific offence criminalising the corporate failure to prevent modern slavery. There are several reasons for this confined scope, all of which aim to increase the likelihood that the proposed offence will be accepted, implemented and enforceable in Australia.

Limiting the scope of the offence to modern slavery will streamline compliance and enforcement efforts. It allows the focusing of legal resources on one substantive offence type, rather than a group of disparate, often tangentially related human rights violations. Additionally, failure to prevent offences remain relatively novel and have yet to be applied in the context of human rights abuses. Therefore, it is appropriate to evaluate the practical strengths (and weaknesses) of the model in relation to a specific human rights violation before expanding the model to all human rights abuses.

Finally, the failure to prevent model is targeted towards corporate offenders. Modern slavery is a human rights violation directly related to corporate misconduct.[164] In contrast, the responsibility for the protection of many human rights is more readily attributable to states, for instance the responsibility to protect the right to education.[165] Therefore, a failure to prevent model for corporations is more fit for purpose in the context of modern slavery, compared to other human rights abuses which do not have the same corporate nexus.

Based on the above points, this article has developed a draft provision

entitled, ‘The Failure of a Commercial Organisation To Prevent Modern Slavery’, to be inserted into the Criminal Code.[166] This provision represents an integration of comparative and international legal approaches, uniquely adapted to the Australian legislative context.

The proposed failure to prevent modern slavery offence and accompanying defence is analogous to the UK’s failure to prevent bribery offence, which has been successfully tried and tested for over 10 years.[167] The actual wording of the proposed failure to prevent modern slavery offence, including definitions, is also influenced by the Legally Binding Instrument, an emerging piece of international law aimed at regulating transnational corporate activity.[168] Independent, expert stakeholders have already deliberated over this language[169] and it is advantageous to integrate accepted international legal concepts into domestic law, as was done in the context of bribery, to promote consistency and a shared normative understanding of the targeted conduct. Finally, the recommended penalty provision aligns with Australia’s penalty regime for bribery, ensuring legal consistency within the Australian context.[170]

270.14 Failure of commercial organisations to prevent modern slavery

(1) A relevant commercial organisation (‘R’) is guilty of an offence against this section for its failure to prevent another legal or natural person (an ‘associate’) from causing or contributing to modern slavery.

(2) It is a defence for R to prove that it undertook comprehensive human rights due diligence to prevent its associate from causing or contributing to modern slavery.

(3) For the purposes of this section, an associate causes or contributes to modern slavery if, and only if, an associate is or would be guilty of an offence under Division 270 or Division 271 of the Criminal Code Act 1995 (Cth) whether or not the associate has been prosecuted for such an offence.

(4) In this section:

associate means:

(a) any legal or natural person who performs services for or on behalf of R;

(b) the capacity in which an associate performs services for or on behalf of R is not relevant;

(c) whether or not an associate performs services for or on behalf of R is to be determined by reference to all the relevant circumstances and not merely by reference to the nature of the relationship between an associate and R.

Note: This definition includes, but is not limited to, an employee, agent, subsidiary, supplier or subcontractor.

relevant commercial organisation means:

(a) a body which is incorporated in Australia;

(b) any other body corporate (wherever incorporated) carrying on business in Australia, a State or a Territory within the meaning of section 21 of the Corporations Act 2001 (Cth);

(c) a corporate Commonwealth entity, or a Commonwealth company, within the meaning of sections 89(1), 10(1) and 11 of the Public Governance, Performance and Accountability Act 2013 (Cth);

(d) any other partnership, or other entity, whether incorporated or unincorporated, if:

(i) the entity is formed or incorporated within Australia; or

(ii) the central management or control of the entity is in

Australia.[171]

Penalty for body corporate

(5) An offence against subsection (1) committed by R is punishable on conviction by a fine not more than the greatest of the following:

(a) 100,000 penalty units;

(b) if the court can determine the value of the benefit that R, and any body corporate related to the R, have obtained directly or indirectly and that is reasonably attributable to the conduct constituting the offence—three times the value of that benefit;

(c) if the court cannot determine the value of the benefit—10% of the annual turnover of R during the period of 12 months ending at the month in which the conduct constituting the offence occurred.

There are several important features of this draft provision which warrant further explanation. First, the provision is clearly and unambiguously drafted as a strict liability offence. According to s 270.14(1), the offence is not contingent on a fault element such as knowledge, recklessness or negligence as is typical with other criminal offences.[172] Rather, the corporate defendant will be found guilty of the offence if an associate is or would be guilty of an offence under

divs 270 or 271 of the Criminal Code per s 270.14(3). Criminal liability arises irrespective of whether the associate has been convicted of an offence. Rather, the prosecutor must merely put forward evidence demonstrating a breach of either of these divisions.

Second, and as will be discussed further below, s 270.14(2) contains a full defence. The defence reverses the legal burden such that it rests on the defendant; this is explicit in the language that the defendant will be absolved from guilt to the extent it can demonstrate it undertook comprehensive HRDD to prevent its associate from causing or contributing to modern slavery.

Third, there is no definition of modern slavery provided and the underlying criminal offence triggering s 270.14 is not ‘modern slavery’. Rather, modern slavery is understood by reference to the criminal offences contained in divs 270–1 of the Criminal Code.[173] In this way, the proposed s 270.14 leverages the pre-existing modern slavery legal framework rather than establishing a completely new, underlying offence of modern slavery. This prevents the proliferation of additional legislative provisions, allowing focus to settle on the specific failure to prevent offence. Moreover, divs 270–1 have already been subject to judicial interpretation.[174] Thus, there is some certainty in the meaning and application of these provisions, whereas a new definition of modern slavery does not have the advantage of such legal precedent. Furthermore, these existing provisions will be reviewed and updated as part of the normal legislative review process.[175] By referencing these provisions in the proposed failure to prevent offence, any updates or improvements to the underlying offence will be immediately captured in the failure to prevent offence too.

Fourth, the proposed failure to prevent provision applies to ‘relevant commercial organisations’. This is a broad definition, imbuing the provision with cross-jurisdictional effect. The provision is not merely concerned with conduct of Australian companies, occurring within Australia. ‘Relevant commercial organisation’ applies to entities incorporated in Australia, and entities incorporated elsewhere but where that entity has a place of business in Australia, and captures conduct occurring anywhere in the corporate supply chain.[176] This is useful to prevent companies from circumventing liability by incorporating in foreign jurisdictions. The extraterritorial reach of this provision also appropriately reflects the cross-jurisdictional nature of large corporate structures and anticipates the common corporate practice of conducting operations transnationally, often in jurisdictions lacking strong labour laws.[177]

Fifth, the provision does not define an associate by reference to the nature of the relationship between the associate and the corporate defendant. It should be recalled that under traditional criminal law models, liability must flow from an individual with a specific relationship vis-a-vis the corporation.[178] However, it has already been demonstrated that the nature of the relationship between parties is not an appropriate way to attribute liability in the context of transnational crimes. Rather, and as drafted above, an associate is defined by reference to the services it performs for or on behalf of the corporation, appropriately capturing actors across all tiers of corporate operations and jurisdictions.

Finally, the structure and form of the proposed penalty provision is modelled on the penalty provision for bribery.[179] This statutory penalty is significant so as to reflect the gravity of the crime of modern slavery, which involves objectively serious exploitation.[180] Such a penalty ensures that corporate offenders are ‘adequately punished’,[181] the offender and other corporations are deterred from committing similar offences[182] and the significant harms arising from the corporation’s conduct are denounced.[183] This penalty provision does not

restrict alternative claims, whether criminal or civil, pursued by individual

victims of corporate exploitation.[184]

The penalty amount may be adjusted during sentencing pursuant to

established principles.[185] It is common for discretionary discounts to be applied where a corporate offender self-reports misconduct, cooperates with relevant law enforcement authorities or demonstrates remorse, contrition and a

genuine desire to facilitate its own rehabilitation.[186] Finally, prosecution and

sentencing under s 270.14 may not occur where the parties enter into a deferred

prosecution agreement (‘DPA’) as will be discussed in Part V.

As in the bribery context, a failure to prevent modern slavery offence should have a full, statutory defence of HRDD. The suggested framing is as follows:

270.14 Failure of commercial organisations to prevent modern slavery

(2) It is a defence for R to prove that it undertook comprehensive human rights due diligence to prevent its associate from causing or contributing to modern slavery.

It is not the objective of a failure to prevent modern slavery offence ‘to bring the full force of the criminal law’ upon a well-organised commercial organisation, with a strong compliance culture, that experiences an isolated incident of

modern slavery.[187] Such corporations, with demonstrated HRDD compliance, ought to be protected by a full defence were such an isolated incident to occur.

An HRDD defence is proposed for the modern slavery provision rather than the ‘adequate procedures’ defence available in the bribery context. These defences operate in a strikingly similar manner, but a HRDD defence has been proposed to align with existing and emerging international norms. Both defences incentivise corporations to maintain strong measures to prevent, mitigate and address transnational issues to ensure protection against criminal sanction.[188] Both defences incorporate elements of supply chain due diligence to monitor for bribery and modern slavery risks.[189]

However, the adequate procedures defence that exists in the bribery context lends itself more to transnational crimes of a financial character[190] whereas an HRDD defence has a strong nexus with transnational human rights issues. Additionally, HRDD is an international legal concept that is already widely understood, accepted and endorsed by modern slavery experts.[191] Indeed, the reporting criteria under the MSA already incorporate (non-binding) elements of HRDD.[192] Contrastingly, the concept of ‘adequate procedures’ has never been applied in the modern slavery context. Thus, an HRDD defence is more appropriate in respect of the proposed failure to prevent modern slavery

offence, building on existing scholarship, corporate familiarity and emerging international norms.

Section 270.14(2) does not expressly stipulate what constitutes HRDD for the purposes of successfully arguing this defence. A prescriptive legislative approach to HRDD has been purposely avoided to allow the concept of HRDD to evolve with emerging best practice.[193] An overly prescriptive approach to the definition of HRDD could prevent the application of s 270.14(2) to new and evolving situations, corporate structures and emerging modern slavery risks.[194] Prescription risks placing an excessive focus on processes rather than promoting meaningful modern slavery prevention outcomes.[195] Keeping the parameters of HRDD broad helps to combat criticism that a failure to prevent model promotes a mere check box, paper compliance approach.[196]

Moreover, corporations are also exposed to different and variable modern slavery risks by virtue of their operations and design. Extractive industries operating in the Democratic Republic of Congo are exposed to significant risks of child labour.[197] The Australian horticultural industry is exposed to significant risks of slavery-like practices, with international workers often having their passports confiscated.[198] The HRDD procedures implemented to prevent modern slavery must be uniquely designed, adapted and proportionate to the specific modern slavery risks of a given corporation, and thus a prescriptive definition is to be avoided.

In lieu of a prescriptive legislative approach to HRDD, this article proposes that a ‘Guiding Framework for HRDD in Respect of Modern Slavery’ (‘HRDD Framework’) should be made available. Given there will be little judicial

direction as to how corporations should comply with s 270.14 until this

provision is contested at trial, guidance must emanate from the legislature, with

appropriate recourse to expert stakeholders, to ensure that such guidance is fit

for purpose.[199]

It is beyond the scope of this article to detail the structure and content of such a guiding framework; however, it is recommended that the guidance be modelled off the UNGP and the Legally Binding Instrument.[200] Incorporating these international legal instruments into the HRDD Framework is advantageous given these instruments are already widely understood, accepted and endorsed by experts on business and human rights.[201] Corporations are strongly encouraged to pursue these steps to demonstrate that they have undertaken comprehensive HRDD, although it should be made clear that these steps will not guarantee that the defence is successful as each case of modern slavery in business operations will be unique and context specific.

It is also noteworthy that Professor John McMillan AO has recently handed down the MSA Review.[202] Recommendation 11 therein proposes the amendment of the MSA to provide that a reporting entity must have a due diligence system meeting the requirements mentioned in the rules made under s 25 of the MSA.[203] To the extent this recommendation is legislated by Parliament, this may guide the scope and operation of an HRDD defence in the context of a failure to prevent slavery offence under the Criminal Code.

Ultimately, this article has proposed a failure to prevent modern slavery

offence and supporting defence that is aligned with the objective of enhancing the effectiveness of Australia’s modern slavery law framework. An attempt has been made to respond to potential challenges and limitations likely to be

encountered during the drafting process. On this basis, this article now turns to the question of viability, which will be analysed and tested in Part V with

reference to three important factors.

Having considered the failure to prevent model and how it may be extended to modern slavery, it is pertinent to turn to a more targeted consideration of the primary question underpinning this article. That is, whether a failure to prevent modern slavery offence is a viable mechanism to enhance Australia’s modern slavery legal framework.

Viability will be assessed with reference to three factors: (i) the ability of this model to remedy the deficiencies in Australia’s modern slavery legal

framework;[204] (ii) the model’s compatibility with Australia’s criminal law

tradition; and (iii) the model’s compatibility with Australia’s existing system of

corporate regulation.

A failure to prevent modern slavery offence remedies the deficiencies in

Australia’s modern slavery legal framework by overcoming the constraints of Australia’s nominalist corporate criminal liability approach. A nominalist

theory of corporate criminal liability positions corporations as an abstract legal fiction, lacking independent existence beyond the individuals within the

corporate collective.[205]

It should be recalled that pt 2.5 of the Criminal Code establishes the principles for attributing corporate criminal liability. These principles, and Australian criminal law more generally, are underpinned by nominalist theory.[206] This is evidenced by the requirement that the physical and fault elements of a criminal offence will only be attributable to the corporation where the offence is

committed by an employee, agent or officer of the corporation acting

with authority.[207]

It is recognised jurisprudentially that a corporate criminal law approach grounded in nominalist principles is neither fit for purpose nor appropriately adapted to the reality of contemporary corporations and transnational issues such as modern slavery.[208] Contemporary corporate structures are diffuse in nature and opaque by design.[209] Control of corporate operations is decentralised to a variety of individuals and spread across vast, transnational supply chains.[210] Individuals in the middle and lower tiers of corporate management are typically the key facilitators of modern slavery.[211] However, they are not the class of individuals through which criminal liability may flow to the corporation, in accordance with nominalism.[212] Resultingly, this has facilitated corporate impunity for modern slavery.[213]

The proposed failure to prevent modern slavery offence remedies this deficiency. The proposed offence embodies a realist approach to corporate criminal liability. A realist theory of corporate criminal liability is premised on organisational culpability, viewing the corporation as a distinct entity with its own objectives, culture and personality beyond its officers, employees and agents.[214]

The proposed offence does not require criminality to flow from a select few individuals in order to impute liability on the corporation. Rather, liability extends deep into the corporate supply chain, capturing a variety of actors cross-jurisdictionally, involved both within and beyond primary business operations.

This means the failure to prevent modern slavery offence is responsive to the decentralised and opaque nature of contemporary corporate structures. The offence anticipates that personnel beyond employees, officers and agents may cause or contribute to modern slavery.[215] However, this fact does not impede the attribution of criminal liability as it would under the nominalist tradition.

Part III suggested stronger legislative design, giving rise to criminal liability, was more influential in shaping substantive private governance practices than a softer framework with minimal penalties for noncompliance. A softer framework fails to elicit meaningful changes in private governance behaviours as there is no real incentive to make such changes.

Australia’s MSA falls within the latter category: a piece of ineffective legislation predicated on a misplaced faith in consumer purchasing power and lacking penalties for noncompliance. Conversely, the proposed failure to prevent modern slavery offence gives rise to corporate criminal liability. The offence is also accompanied by substantial monetary penalties. Additionally, where a corporation is found guilty of failing to prevent this serious human rights abuse it will incur significant reputational damage. This harder approach to modern slavery regulation will reassert modern slavery as a serious operational risk within corporate governance discourse and practice.[216] This will act as a

powerful incentive for corporations to incorporate robust and meaningful

anti-slavery standards and practices across their operations.

It should also be recalled that the MSA is predicated on market-outsourced enforcement.[217] However, the particular role of this ‘market mechanism’ is inflated, significantly hampering the effectiveness of Australia’s modern slavery legal framework.[218] The proposed failure to prevent modern slavery offence relieves consumers and the broader market of the modern slavery enforcement burden. Rather, the enforcement burden is shifted back to prosecutorial agencies who must decide whether to bring charges against a corporate defendant for failing to prevent modern slavery on the basis of available evidence.

Enforcement will require the allocation of additional resources by government to allow prosecutors to dispense with this mandate.

To supplement this increased enforcement burden, the proposed provision enhances the compliance burden on the corporate defendant. The proposed failure to prevent modern slavery offence is accompanied by an HRDD defence. To rely on this defence and avoid criminal sanction, corporations must undertake comprehensive HRDD in accordance with the HRDD Guiding Framework proposed in Part IV. This shifts the responsibility onto corporations to prevent and address modern slavery within their supply chains.[219] It is anticipated that shifting the enforcement of modern slavery from the market onto expert

prosecutorial authorities and corporate defendants themselves, as in the

current approach to bribery,[220] will enhance the effectiveness of Australia’s modern slavery legal framework.

A significant deficiency in Australia’s modern slavery legal framework is that disclosure-based legislative schemes have resulted in the proliferation of social auditing in substitution of comprehensive HRDD. It should be recalled that

social auditing is an inherently superficial tool in detecting and measuring exploitative labour conditions.[221] Social auditing provides low-quality information outcomes, which are often the result of supplier fraud and coercion.[222] Social auditing targets tier one suppliers, notwithstanding that labour exploitation primarily occurs in the lower tiers of corporate production.[223] Moreover, social auditing often becomes a check box approach to modern slavery compliance, unsuited to addressing the underlying causes of this issue.[224] It is

proposed that preventing modern slavery in global supply chains requires

recourse to robust HRDD approaches rather than superficial social auditing.[225]

HRDD offers a meaningful and holistic way for corporations to actively manage and prevent human rights impacts connected to their business activities.[226] Whilst social auditing may reveal modern slavery risks or issues within a supply chain, there is no binding requirement for corporations to remediate harmed persons or develop effective solutions to mitigate the issue.

Contrastingly, HRDD specifically requires that where modern slavery risks or issues are identified, transparent remediation is pursued.[227]

The proposed failure to prevent modern slavery offence is accompanied by an HRDD defence. Evidence that a corporation undertakes a comprehensive and recurring programme of HRDD is necessary to successfully claim the defence under s 270.14(2). In this way, a failure to prevent modern slavery offence strongly incentivises corporations to undertake HRDD, unlike the superficial social auditing approaches which have emerged from mandatory modern slavery disclosure schemes. This proposed offence will significantly increase the quality of modern slavery prevention and remediation activities. Therefore, it seems likely that the proposed provision and defence will go some way to

remedying existing limitations in Australia’s modern slavery legal framework.

Next, it is necessary to assess the compatibility of the proposed offence with Australia’s criminal law tradition, given that the proposed failure to prevent modern slavery provision is drafted as a criminal offence. This section will traverse and dispel several criticisms of the failure to prevent model to demonstrate that the proposed failure to prevent modern slavery offence is compatible with Australia’s criminal law tradition.

The failure to prevent model places a legal burden on the defendant.[228] The defendant is required to prove their innocence by presenting a successful defence.[229] This reverses the Australian criminal law tradition whereby the legal burden rests on the Crown to prove beyond reasonable doubt each element of an offence.[230] Assigning the legal burden to the Crown guarantees an accused is presumed innocent.[231]

It could be contended that by reversing the legal burden, the failure to

prevent model represents an unacceptable encroachment on the presumption of innocence and fair trial rights.[232] Offences reversing the legal burden certainly interfere with the presumption of innocence.[233] However, and in the Australian context, this argument does not undermine the viability of a failure to prevent modern slavery offence to enhance Australia’s modern slavery

legal framework.[234]

Fair trial rights and the presumption of innocence are protected by Australia’s common law.[235] These common law rights are considered ‘fundamental’,

meaning that they are essential to the efficacy of Australia’s legal system.[236] There is a strong statutory presumption that Acts of Parliament cannot abrogate

fundamental rights, such as the right to a fair trial.[237]

The courts have consistently held that statutes should not be construed as infringing fundamental common law rights unless the legislature is ‘unambiguously clear’[238] in its intention to depart from such rights.[239] Where legislation encroaching on a fundamental common law right is unclear, it will be read down to prevent such an encroachment.[240] However, to the extent that it is the clear and unambiguous intention of parliament to introduce an offence reversing the legal burden (such as a failure to prevent modern slavery offence), the courts will construe and apply this legislation as drafted.[241]

The High Court provides that it is within the competence of the legislature to regulate the incidence and reversal of the legal burden.[242] As such, several reverse onus offences under Australian law, many of which are related to corporate regulation,[243] have been passed by Parliament and not read down by the High Court.[244] This suggests that the proposed failure to prevent modern slavery offence will not automatically be disallowed by Parliament or the courts due to its status as a reverse onus offence.[245]

The right to a fair trial and the presumption of innocence are common law rights developed by the courts in light of colliding interests and values.[246] These rights essentially reflect the proper relationship between a vulnerable defendant and the well-resourced state, affording protection to the former by placing higher standards on the latter.[247] However, conditions in society have radically changed since the institution of such fundamental common law rights. Corporations have become vast entities, operating transnationally, exponentially increasing revenue and engaging in significant human rights abuses.[248] Corporate defendants often possess resourcing capabilities far exceeding governments and prosecutorial agencies.[249]

Justice Isaacs has provided instructive commentary on this issue: ‘[t]he usual path leading to justice, if rigidly adhered to in all cases, would sometimes prove but the primrose path for wrongdoers and obstruct the vindication of the law’, and as such, there are circumstances which justify and indeed require reversing the legal burden.[250] Justice McHugh in Malika Holdings Pty Ltd v

Stretton further identified that

[w]hat [rights are] fundamental in one age or place may not be regarded as

fundamental in another age or place. When community values are undergoing radical change ... few principles or rights can claim to be so fundamental that it is unlikely that the legislature would want to change them.[251]

The right to a fair trial and presumption of innocence (as they apply to corporate defendants) must be viewed in light of contemporary corporate operations, the gross human rights abuses perpetrated by corporations and the emerging power imbalances between influential, well-resourced corporate defendants and prosecutorial agencies. This jurisprudence demonstrates that statutory

offences reversing the legal burden are not inherently incompatible with

Australia’s criminal law tradition and may indeed be required to facilitate the

administration of justice in light of changing societal expectations and values.

The proposed failure to prevent modern slavery offence is clearly and

unambiguously drafted to reverse the legal burden; this is a permissible

encroachment on common law rights adapting to meet societal expectations in the age of corporatocracy.[252]

It is likely, given the UK experience,[253] that a DPA scheme would need to be introduced in the Australian context to support the operation of the proposed failure to prevent modern slavery offence. Thus, it is important to consider this prosecutorial tool as part of the failure to prevent framework. This article

contends that DPAs strengthen the viability of the failure to prevent modern slavery offence and complement Australia’s criminal law tradition.

A DPA is a negotiated agreement entered into between a prosecutor and a corporation at the prosecutor’s discretion.[254] The negotiation and enforcement of DPAs, including actions for material contraventions, are supervised by a judge.[255] A DPA allows the suspension of prosecutorial action, notwithstanding evidence of criminal wrongdoing, if the corporation complies with certain

conditions specified by the prosecutor and endorsed by a judge.[256]

DPAs are an alternative strategy in the prosecutorial toolkit to respond

to corporate crime, transcending the traditional binary choice: to prosecute

or not to prosecute.[257] Additionally, and for corporations, entering into a

DPA and cooperating with prosecutors to rectify criminal wrongdoing

minimises reputational damage.[258] DPAs have preventative and

restorative aims.[259] DPAs may require payment of a penalty to deter future wrongdoing[260] or payment of compensation to a community significantly impacted by corporate crimes.[261] DPAs may also require the review and improvement of compliance programs to a standard specified by prosecutorial agencies[262] or the appointment of independent auditors.[263]

Early research suggests that DPAs may increase the likelihood of effecting behavioural and cultural change within corporations.[264] However, there is currently no evidence that DPAs prevent future corporate crime, though they remain highly preferable to no prosecution at all or a failed prosecution.[265]

In 2019, the Crimes Legislation Amendment (Combatting Corporate Crime) Bill 2019 (Cth) sought to introduce a DPA scheme in Australia.[266] This Bill has since lapsed,[267] so it is pertinent to look to comparative jurisdictions. A DPA scheme was introduced in the UK in 2013.[268] DPAs are now available in respect of a wide range of economic offences,[269] including the offence of failing to prevent bribery.[270]

For instance, in 2017, the SFO entered into a DPA with Rolls-Royce after the company’s alleged commission of multiple offences, including the failure to prevent bribery.[271] In consideration of £497,252,645 (representing disgorgement of profit and penalties before interest) and guarantees by Rolls-Royce (to cooperate with the SFO, to amend anti-bribery compliance programmes to SFO specifications and to undergo independent audit), prosecutors suspended criminal proceedings.[272] The SFO has negotiated eight such DPAs with

corporate defendants for failing to prevent bribery.[273] In light of the UK

experience, it is clear that a failure to prevent modern slavery offence should be

accompanied by a DPA regime in the Australian context.

Existing literature presents two main arguments to suggest that DPAs undermine Australia’s criminal law tradition. First, a failure to prevent offence contains an in-built defence. For bribery, this is the adequate procedures defence.[274] A similar HRDD defence is proposed in respect of a failure to prevent

modern slavery offence. The corporate defendant has the opportunity to raise

this defence and will avoid criminal liability to the extent that this defence is

successfully argued.

The inclusion of DPAs in the failure to prevent model duplicates the mechanisms through which a corporation may avoid a finding of criminal guilt. In such circumstances, a DPA may be considered a ‘second bite of the cherry’.[275] This is arguably contrary to Australia’s criminal law tradition which allows

defendants to rely on an exception or defence; to the extent that the defence is not successfully argued, criminal guilt ensues.

Additionally, the inclusion of DPAs raises important questions about equality before the law.[276] It is a unique advantage for corporate offenders to have dual means of circumventing criminal liability. Such an advantage is not

bestowed on individual defendants, at least not in Australia.[277] While an individual defendant may enter a plea bargain, they are required to make an admission of criminal guilt. Entering a DPA, however, requires no

such admission.[278]

Despite these criticisms, it is argued here that the existence of an in-built defence and the availability of a DPA settlement should not be framed as inequitable or undermining Australia’s criminal law tradition. Rather, they should be viewed as additional safeguards for the corporate defendant in the context of a particularly onerous offence that reverses the legal and evidentiary burden (interfering with certain fair trial rights).

An additional critique is that DPAs may erode and ultimately replace criminal prosecution, significantly undermining Australia’s criminal law tradition.[279] In this regard, it is noted that only five failure to prevent bribery cases in the UK have involved criminal trial and conviction.[280] Conversely, the SFO has entered into eight DPAs with separate corporate defendants in relation to failures to prevent bribery.[281]

Because the DPAs are specifically designed to suspend criminal prosecution, to the extent that the DPA is appropriately performed, criminal conviction is avoided. This has provoked scholarly criticisms that DPAs are the corporate version of a ‘[g]et [o]ut of [j]ail [f]ree [c]ard’, ‘state-sanctioned “corporate payoffs”’ or a mere ‘cost of doing business’.[282] This arguably reduces the deterrent impact of a DPA and also the underlying criminal offence to which it applies. Moreover, prosecuting criminal activity involves legal contestation and judicial interpretation of legal principles. Where DPAs supersede criminal prosecution, the development of judicial precedent is impacted, potentially undermining a core feature of Australia’s criminal law tradition which ensures legal consistency and predictability.

Contrary to the above critique, evidence from comparative jurisdictions that have had a functioning DPA regime for over a decade offers no statistical support for the assertion that DPAs have superseded or replaced criminal prosecution.[283] Whilst DPAs have grown in popularity, they have not replaced traditional criminal justice settlements such as plea deals nor have they replaced the use of criminal prosecution against major corporate defendants.[284] Rather the evidence suggests that DPAs have emerged as an additional tool which prosecutors may employ in appropriate circumstances.[285]

Considering the above critiques and counterarguments, it is asserted that the DPA is a pragmatic mechanism which complements, rather than undermines, Australia’s criminal law tradition. The availability of DPAs does not necessarily mean that such a mechanism will be used to settle every situation of corporate criminal misconduct. Where the circumstances are appropriate, and at the

sole discretion of the prosecutor, a DPA may be negotiated with a

corporate defendant.[286]

In the modern slavery context, a DPA may also support restorative outcomes, for example by requiring a corporate defendant to compensate employees or contractors who were not paid a living wage. The DPA may specify an HRDD framework that the corporate defendant must implement under supervision of an independent auditor and may also require cooperation with law enforcement in pursuing the prosecution of individual persons associated with the commission of modern slavery. Importantly, where DPA terms are not met by the corporate defendant to the requisite standard, the prosecutor retains the ability to pursue criminal proceedings.[287] This advances restitutionary and rehabilitative criminal law aims rather than completely undermining the criminal law.[288] A DPA can be seen as a first avenue for remediation rather than a circumvention of the legal framework.

Entering into a DPA in respect of a failure to prevent modern slavery offence may also increase efficiency and decrease costs by enabling parties to produce a statement of agreed facts and negotiate a settlement where appropriate, rather than participate in adversarial criminal contest.[289]

It should also be noted that if a DPA is available in respect of a failure to prevent modern slavery offence, this may encourage early self-reporting of modern slavery incidents occurring within supply chains.[290] That is, corporations may be less inclined to conceal human rights abuses where there are

alternative settlement options to criminal sanction available.[291]

Finally, research suggests that the use of enforceable undertakings, which are very similar to DPAs, has driven meaningful changes to compliance practices amongst peer corporate stakeholders.[292] Enforceable undertakings are an administrative remedy to address contraventions of legislation administered by certain regulators.[293] Enforceable undertakings may be initiated by either an offender or a regulator. The terms of an enforceable undertaking are negotiated by the parties and the undertaking can be enforced by a court. Arguably, DPAs have the potential to similarly deter infringing conduct to positively shift

industry behaviour in support of strong human rights outcomes.

In light of these arguments, it appears that the primary concerns associated with DPAs may be alleviated if a precondition to entering a DPA is that the corporate offender make an admission of wrongdoing.[294] This resolves criticism that DPAs completely undermine the moral authority of criminal investigation and prosecution, as there is a clear and public admission of wrongdoing.[295] It also minimises corporate perceptions of DPAs as merely a ‘cost of doing business’ to placate prosecutorial authorities.[296] Combined with other established benefits, it seems that a failure to prevent offence, accompanied by an HRDD defence and the possibility of a negotiated DPA, establishes a well-rounded suite of legal tools that are compatible with Australia’s criminal law tradition and responsive to the unique challenges of transnational corporate regulation and modern slavery risks.

The proposed failure to prevent modern slavery offence specifically targets

corporations. Therefore, the viability of this offence must also be assessed

by reference to its compatibility with Australia’s broader system of

corporate regulation.

One of Australia’s predominant regulatory strategies is responsive regulation, derived from responsive regulation theory (‘RTT’).[297] This is perhaps most obviously evidenced by the pyramidal enforcement models adopted by Australia’s major corporate regulators.[298] It is beyond the scope of this article to critically analyse RRT, though a brief background is necessary. RRT proposes that effective and legitimate corporate regulation is premised on an escalating

approach, maximising incentives for early compliance and reserving sanctions for egregious corporate misconduct.[299]

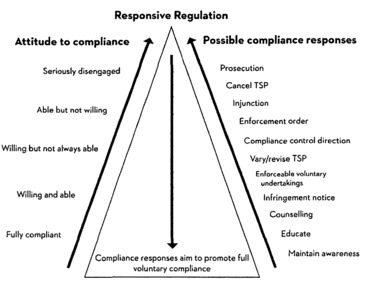

Figure 1: Australian Office of Transport Safety Responsive Regulatory Philosophy[300]

RRT emphasises the importance of ‘collaborative capacity building’: achieving positive regulatory outcomes through support, education, signalling and the use of sanctions (where necessary).[301] The essence of responsive regulation is that regulators should not immediately use compliance responses at the top

of the regulatory pyramid. Rather, regulators should escalate response options

as necessary.[302]

The proposed failure to prevent modern slavery offence is a criminal offence. The primary compliance responses to breaches of this offence are prosecution and criminal sanction. These compliance responses are, prima facie, at the apex of the regulatory pyramid.[303] It may be argued that recourse to prosecution for failing to prevent modern slavery is discordant with Australia’s responsive, co-regulation logic, which reserves criminal sanction for extraordinary situations. However, this article contends that such an argument does not hold up to critical analysis.

The failure to prevent modern slavery offence is accompanied by an HRDD defence. This defence represents an incentive for early compliance with the criminal law. To the extent that a corporation undertakes comprehensive HRDD, this will prevent recourse to criminal prosecution and sanction.

This strongly aligns with responsive regulation, maximising incentives for

early compliance.[304]

Moreover, the existence of a DPA regime to settle failure to prevent modern slavery offences strongly supports capacity building, a key feature of responsive regulation.[305] DPAs are a negotiated, dialogue-based approach enabling prosecutors to work with corporations to develop their procedures and internal processes, ultimately enhancing positive corporate performance.[306] To the extent that a DPA is not complied with, prosecutors may move up the pyramid and pursue criminal prosecution as per a responsive regulatory approach.[307] In this way, the proposed failure to prevent modern slavery offence is designed in a manner compatible with Australia’s prevailing system of corporate regulation. This is a key indicator of the offence’s viability.

A significant criticism levelled at the failure to prevent model is that imposing liability on a company for third-party criminal misconduct that occurs within its supply chain is unfair, disproportionately burdens corporate stakeholders and ultimately stifles legitimate economic activity (due to delayed and

frustrated business transactions).[308] However, this article asserts that the

purported regulatory burden is neither inefficient nor unfair and should not be

presented as a factor undermining the viability of a failure to prevent modern

slavery offence.

First, and under the current MSA,[309] there are no positive obligations imposed on corporations to prevent and address modern slavery in supply chains. This is unfortunate given transnational corporations are highly susceptible to being involved in the offence of modern slavery and are most able, economically and organisationally, to aid in its prevention.[310] The Australian Federal Police (‘AFP’) and Commonwealth Director of Public Prosecutions (‘CDPP’) are entirely responsible for modern slavery law enforcement.[311] The regulatory compliance burden for modern slavery also falls heavily on the market,

with consumers expected to avoid transacting with corporations that have